Solend Whale fiasco

Bancor IL Protection joke

Synthetix hit 200M+ day trade volume

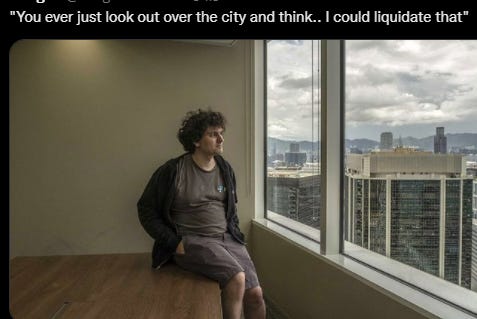

Solend - Whale Fiasco 巨鲸事件

Background:

A whale has a massive position of $170M SOL deposited and $108M stables borrowed. they're currently 95% of the SOL deposits and 86% of USDC borrows.

If SOL drops to $22.30, the whale's account becomes liquidatable for up to 20% of their borrows (~$21M). It'd be difficult for the market to absorb such an impact since liquidators generally market sell on DEXes.

Enact special margin requirements for large whales that represent over 20% of borrows and grant emergency power to Solend Labs to temporarily take over the whale's account so the liquidation can be executed OTC.

全网群嘲the lease DeFi thing a DeFi protocol can ever propose.

Invalidate the last proposal

Bancor IL protection paused 无偿损失保护机制暂停

Background:

Bancor’s Impermanent Loss Protection is temporarily paused. IL protection will be reactivated on the protocol as the market stabilizes. This is a temporary measure to protect the protocol and its users.

IL Protection/Insurance: If the user has suffered any IL, fees earned by the protocol's pool tokens(BNT) are used to compensate for the IL.

Synthetix hit 200M+ day trade volume

kwenta is syns leverage trading protocol

Lyra is options trading protocol

Polynomial is syns vault

Atomic swap on Curve

USDC to sUSD cheaply (sUSD/3CRV pool)

sUSD to sETH cheaply (Synthetix)

sETH to ETH cheaply (sETH/ETH pool)

At first Synthetix does asynchronous trade execution (aka fee reclamation). Cuz the pool user experience, the SIP-120 is proposed. === lets Synthetix exchanges on L1 be atomic and now everybody can use them to get good price execution on ETH <> USD <> BTC (as long as there is enough liquidity in the Curve pools)